Congressional Budget Office pegs 'big, beautiful' bill price tag at $2.4 trillion

Published in Political News

WASHINGTON — The House-passed budget reconciliation bill would increase deficits by $2.4 trillion over a decade and ultimately result in nearly 11 million individuals losing access to health insurance, the Congressional Budget Office said Wednesday.

The new numbers are largely in line with preliminary estimates, but nonetheless could complicate the path forward for President Donald Trump’s “big, beautiful” budget package, which is undergoing a thorough Senate review this week. Democrats were quick to jump on the CBO score.

“Even after the biggest cuts to health care and food assistance in U.S. history, the Republican bill for billionaires would still add a historic amount to our debt — all to give the ultra-rich more tax breaks,” House Budget ranking member Brendan F. Boyle, D-Pa., said in a statement.

The data doesn’t include the so-called dynamic effects of the bill on the economy, which could lower the overall price tag. The Joint Committee on Taxation, which analyzes tax provisions, previously said an earlier version of the House bill would cost about $100 billion less than advertised due to positive growth effects. The CBO said an updated economic analysis of the full package will be forthcoming.

Republicans have repeatedly bashed the CBO methodology, particularly for allegedly low-balling baseline economic forecasts at about 1.8% annual growth.

Trump called that estimate “ridiculous and unpatriotic” in a post on his social media network, Truth Social. And Speaker Mike Johnson, R-La., said during a Sunday talk show appearance that the CBO’s growth projections are “off every single time” and that the bill would actually reduce, not increase, the deficit.

The House budget blueprint for the reconciliation package assumed more robust growth of about 2.6% per year, which assuaged GOP conservatives’ deficit fears since that growth could boost revenue enough to paper over the “static” deficit forecast, at least in theory.

That assumption left room for about $2.5 trillion for increased deficits using conventional CBO scoring, so the new numbers released Wednesday meet that target with a little room to spare.

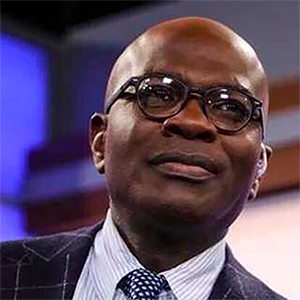

House Majority Leader Steve Scalise, R-La., rejected the CBO analysis and faulted the nonpartisan scorekeeper for not taking account of the additional revenue that he said would come from economic growth spurred by the bill’s tax cuts.

“They’ve always been wrong and they’ve always ignored what tax cuts will do to grow the American economy,” he said at the House GOP’s weekly news conference. “We’ve got to play by the rules of the referee, but the referee has been wrong,” Scalise said.

He said the CBO projected a $1.5 trillion increase in the deficit from the 2017 tax cuts and “they were off by more than one and a half trillion dollars.” The CBO has attributed that disparity mostly to the impact of inflation and tariffs since their initial projection.

Still, anytime legislation is forecast to increase deficits by trillions of dollars it becomes a major political headache for the party in power. Senate Majority Leader John Thune, R-S.D., declined to react to the CBO score when asked by reporters on Wednesday.

The data also don’t show the effects of additional interest payments needed to service the rising debt, which could push the total cost closer to $3 trillion, before dynamic growth effects are incorporated.

The CBO score nets out to $2.4 trillion after a $3.7 trillion estimated revenue reduction from tax cuts, minus an estimated $1.3 trillion in spending cuts. The revenue number includes some deficit savings from new tax increases, fees and royalties, like repeal of clean-energy tax credits and new fees for electric vehicle purchases and immigration applications and leasing revenue from oil and gas exploration.

At the same time, the CBO responded to a separate request from Democratic leaders for a budgetary and economic analysis of Trump’s tariff actions this year.

If the president’s “reciprocal” tariffs and other new levies imposed under the International Emergency Economic Powers Act hold up in court, the cumulative effect if the duties remain in place would be to cut deficits by $2.8 trillion over a decade. That figure incorporates a dynamic analysis reducing annual economic growth and boosting inflation.

Democrats also trained their fire on the estimate of 10.9 million individuals likely to lose health insurance by the end of the 10-year period covered by the bill.

House Energy and Commerce ranking member Frank Pallone Jr. pointed out that figure doesn’t include nearly 5 million more individuals who could lose coverage due to expanded subsidies for buying insurance on the 2010 health care law’s exchanges lapsing at the end of this year. The GOP bill would not extend those provisions.

“The truth is Republican leaders raced to pass this bill under cover of night because they didn’t want the American people or even their own members to know about its catastrophic consequences,” Pallone, D-N.J., said in a statement.

The CBO analysis said the numbers include 1.4 million people who would no longer have Medicaid coverage due to being “without verified citizenship, nationality or satisfactory immigration status.”

Before accounting for interactions between parts of the bill, the CBO tallied up at least $1.2 trillion in 10-year cuts to Medicaid and exchange eligibility, between the Energy and Commerce and Ways and Means portions of the bill. Republicans say the cuts are mainly targeted at cracking down on fraud, imposing new work requirements and removing undocumented immigrants’ eligibility for coverage.

The analysis also said premiums for insurance plans purchased on the exchanges would be lower by an estimated 12.2% by 2034.

More information on the health insurance impact is expected later in the day from the CBO, in response to a request from Pallone as well as Senate Finance ranking member Ron Wyden, D-Ore., and House Ways and Means ranking member Richard E. Neal, D-Mass.

“Republicans are lashing out at nonpartisan scorekeepers for doing their jobs because the truth exposes just how cruel and dangerous their plan really is. But the math doesn’t lie. With this plan, the rich get handouts, and everyone else pays the price,” Neal said in a statement.

_______________

©2025 CQ-Roll Call, Inc. Visit at rollcall.com. Distributed by Tribune Content Agency, LLC.

Comments